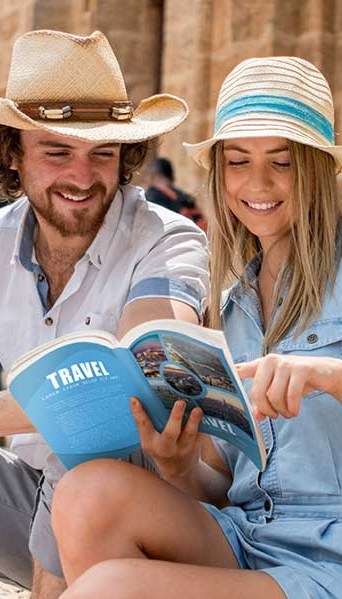

Plan your trip with confidence

Purchase a plan from the world's largest travel insurance and assistance provider.

Explore the world with Allianz Global Assistance

Coverage for one trip

Are you a Canadian resident and plan on taking one or two trips this year? We offer coverage in case you need to cancel your trip before leaving, to protect you if you become sick or injured while travelling (emergency medical insurance), and more.

Coverage for multiple trips

Are you a Canadian resident and plan to travel more than twice in the upcoming months? We offer emergency medical coverage for an unlimited number of trips within 365 days from the start of your coverage.

Visiting Canada Coverage

Are you expecting friends or family to visit Canada? Get the protection they need as a new immigrant, international student, temporary worker or Super Visa applicant.

Why buy travel insurance?

Emergency medical treatment or hospitalization

Medical insurance protection in the event of sudden and unforeseen emergency health and medical situations.

Sickness or injury before or during a trip

Cancel your trip because of an accident, illness or injury to yourself, a family member or travelling companion

Travel delays or interruptions

Receive coverage if your flight is delayed due to weather conditions, volcanic eruptions, natural disaster, or mechanical failure of the connecting carrier

Lost, stolen or delayed baggage

Replacing lost, stolen or damaged luggage can get expensive. Travel insurance may help cover these costs.

Why choose Allianz Global Assistance?

Why choose Allianz Global Assistance?

As a leading travel insurance company and assistance provider, we help Canadians and Visitors to Canada explore the world with peace of mind.

Global Reach

Commercial activity in 75 countries and over 1.2 million medical providers within our global network

Preferred Choice

Over 10 million Canadians supported by our travel

assistance services

assistance services

Own Emergency Centres

In-house medical team of licensed physicians and registered nurses

Robust Operations

72.5 million cases managed globally in 2022, including 11,037 medical repatriations and 1,056 air ambulances chartered